5 Ways to Slash the Cost of Medical School

Medical school has a hefty price tag, but are there any ways to make it less expensive? Here are our best tips.

Google Doesn’t Lie

Have you ever begun to type a question into the Google search bar and been thoroughly amused by the results?

Typing in “why” brings up “why do we yawn,” while “why is” results in “why is the sky blue.” Combine “why” and “medical school,” however, and your first hit will likely be the million-dollar question: “why is medical school so expensive?” Clearly, it’s something many students ponder.

Once you’ve read the many articles attempting to explain to you why medical school is as expensive as it is, your next question will likely be: “Okay, so how do I make it cost LESS?” If there is a verifiable way to do that, you’ll want to know about it. And trust us, it’s been done. We have spoken with students who have gotten plenty of scholarship money to put towards medical school, and even one who not only was granted a full ride, but also receives a stipend while in medical school. You read that right, she makes money in medical school.

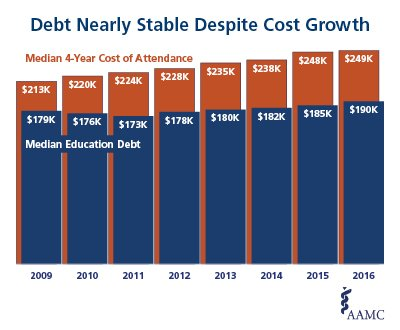

For the average student, however, the cost of becoming a doctor is skyrocketing. It is easy to see that the average debt of medical students is a perfect indicator of this. In 2016, the AAMC found that almost 74% of medical students graduated with tuition debt. The median load turned out to be a whopping $190,000. That’s a dramatic increase since 2000, when the average debt was only $125,372. Get this, some student loan debt can climb up to $300,000. That hurts a bit even just to read.

Further reading: The Reality of Medical School Debt

So, how can we best prepare ourselves to be as cost-conscious as possible when tackling med school? Here are our tips:

Don’t Lose Hope

However staggering the numbers seem, don’t let them deter you from pursuing a true calling to medicine. You’re allowed to be conscious of (and maybe even a little stressed about) the amount of money you will need to spend on medical school. The general consensus, though, is that’s it’s worth the investment.

The job security and income potential attached to a medical career can make up for the enormous front-loaded costs. In fact, senior AAMC research analyst, Jay Youngclaus, confirmed in a 2013 study that physicians in all specialties could still pay back their medical school debt without incurring additional debt. Julie Fresne, the Director of AAMC Student Financial Services contends the same. “There is a concern that the cost of medical school will deter otherwise qualified and underrepresented candidates,” she worries. “We’ve got to get to people younger, earlier; we’ve got to help them understand that they can afford a career in medicine.”

You may not realize it, but there are numerous resources and opportunities available to you to cut the cost of your medical school education. Here are five tips to help you lessen the financial burden.

Senior AAMC research analyst, Jay Youngclaus, confirmed in a 2013 study that physicians in all specialties could still pay back their medical school debt without incurring additional debt.

1. Be Proactive

It’s never too early to start researching your financing options at your prospective medical schools. This should begin with some honest assessments. What level of financial support, if any, can your family feasibly provide? How much can you individually contribute from savings? Once these questions are sorted out, figure out how much tuition remains to be covered. Step two will help you address this remaining number.

A unique and financially more reasonable option to consider is attending a three-year MD program. Be prepared – the curricula of these programs will be substantially more rigorous; at the same time, successful matriculation will often guarantee a spot in a specialized residency.

Let’s say, for the sake of the majority, that you are planning on pursuing the typical 4 year medical school path.

2. Explore Student Financial Aid

Most of you may have explored financial aid options while applying to college. Remember those acronyms: FAFSA, CSS, and SAR? They’ll be relevant again when applying to medical school. Don’t hesitate to reach out to the financial aid officer at each of the schools to which you apply in order to gauge what your financial aid package may entail. These advisers know best what their institutions can offer you, as well as when the funds will be available to you. They can shed light on whether need-based and merit scholarships are offered, and whether full tuition coverage is a possibility.

While you’re doing this, however, know the lingo. Make sure you know the difference between grants (no repayment) and loans (must be repaid). There is also a difference between loans that you have to pay back with interest versus those that do not include interest. Large loans with a high interest rate are going to be exponentially more difficult to pay down, but are unfortunately the most common.

Educating yourself about all of the different ways you can take out loans, as well as knowing exactly how much you need, can help you from falling into the trap of accepting too much aid that will be a pain to repay later.

3. Pay when you can

Once you can factor in the school’s aid, do the math. Use online calculators and figure out what amount is left. Estimate important things like whether you’ll need to find a part-time job, and how much you would ideally need to make. This is for two important reasons: so that you can have money for other interests and so that you do not have to defer loans until residency. Pay what you can while in school, as it will help prevent your balance from exploding once the deferment ends. For instance, with a student balance of $164,800 and 6.00% rate, holding off student loans for residency can add about $30,000 in accrued interest. This would make your new balance about $194,000, and bump up your monthly payments to more than $2,000. Eventually the total cost (including interest) will be about $260,000 repaid over a decade. Make a goal to not pay back more money than you actually owe.

4. Get loan smart

Let’s back up a little bit. When you do choose to take out loans, it’s important to make decisions with the understanding that not all loans are created equal. Students often make the mistake of thinking that the loan with the lowest monthly payment is the best, but this is not always the case. Get as much information as you can regarding interest accrual, deferment options, add-on fees at repayment, and payment plans to make an informed decision. These are all factors that separate good deals from great ones and SimpleTuition can help you calculate all that. If federal student loans aren’t enough to cover the cost, private loans are another option to consider. However, these tend to have many caveats, such as more variable interest rates and non-tax-deductibility.

When you do choose to take out loans, it’s important to make decisions with the understanding that not all loans are created equal.

While finding the best loans, you can help set yourself up for the best loan arrangements by maintaining not only a strong credit score, but also a good credit history. This is especially important when seeking private loans, as the credit score and credit history together inform the private loan lenders whether they can entrust you with a loan. It is important that you have no open collection accounts, delinquent student loans, or “maxed” out credit cards. Make sure you’re in good standing by reviewing your account through your free annual credit report.

Another important thing to know is that you may not be able to take out a private loan by yourself. If you do not qualify to take a loan out by yourself, you will need to do so with a co-signer; often times this will be a parent or guardian, but can be a large financial liability for the co-signer as well. In the case of needing a co-signer, make sure that all parties are aware of the amount, interest rates, and risks involved should you not be able to pay the loan back in a timely manner.

5. Consider Repayment and Forgiveness Programs

If you are willing to commit to practicing medicine in underserved areas or serving as a military physician, there are numerous programs that will subsidize your tuition in exchange for promised work. These include, but are not limited to, the Indian Health Service Corps Scholarships, the Armed Forces Health Professions Scholarship Program, and the National Health Service Corps. There are also other loan forgiveness programs that cover a portion of debt in return for at least two years of service in underserved areas through the nation.

PSLF (Public Service Loan Forgiveness) is another option. We wrote an entire blog on this topic as well, as it is a bit more complicated. The bottom line is that PSLF offers tax-free forgiveness of student loans after ten years of qualifying payments. The caveat? Very few people have successfully received loan forgiveness under this program, and it is not expected to stick around as an option forever.

Conclusion

Medical student debt doesn’t have to be daunting. With research, planning and flexibility, you can cut down on your total out-of-pocket costs while managing your payments well. In addition to reflecting on the tips I’ve presented above, ask yourself some questions, like the following.

-

“Is a separate financial aid application required at my prospective school?”

-

“If I get a scholarship for a year, will I be guaranteed to receive it in the successive years?”

-

“How can I budget my money to cut down on my spending and borrowing?”

Pondering the answers and planning accordingly can help you make great strides when tackling your future medical school debt.

Now we have a question for you to answer below in the comments: would you consider getting a job while in medical school?